The Ultimate Guide to Using a Cost of Living Calculator (2025 Update)

Master cost of living calculators with our comprehensive 2025 guide. Learn how to compare cities, evaluate salaries, plan relocations, and interpret data accurately for smarter financial decisions.

Are you wrestling with a major financial decision like a job offer in a new city, planning your retirement, or deciding where to live as a remote worker? The numbers can be overwhelming. A cost of living calculator is your most powerful ally in cutting through the confusion, but only if you know how to use it effectively. With economic shifts, fluctuating inflation rates, and evolving work patterns defining 2025, understanding how to effectively wield this powerful tool can significantly impact your financial well-being and lifestyle choices. This ultimate guide will equip you with the knowledge to master cost of living calculators, interpret their data accurately, and use them to make smarter decisions for your future. Ready to get started? Try our advanced calculator while following along with this guide.

What Exactly is a Cost of Living Calculator?

At its heart, a cost of living calculator is a tool designed to compare the relative expense of maintaining a specific standard of living across different geographic locations. It moves beyond simple salary figures to answer a more fundamental question: How far will my money actually go? A $90,000 salary might sound fantastic, but its real value – its purchasing power – varies dramatically depending on whether you live in San Francisco, California, or San Antonio, Texas.

These calculators typically measure and compare several key expense categories that constitute a significant portion of household budgets:

- Housing: Often the largest differentiator, encompassing rent, mortgage payments, property taxes, and home insurance.

- Food: Costs for groceries purchased at supermarkets and meals consumed at restaurants.

- Transportation: Expenses related to commuting and travel, including gasoline, public transit fares, vehicle maintenance, and insurance.

- Healthcare: Includes health insurance premiums and typical out-of-pocket medical expenses.

- Utilities: Costs for electricity, heating/cooling, water, and internet services.

- Taxes: Crucial but sometimes overlooked, including state and local income taxes, sales taxes, and property taxes.

- Miscellaneous Goods & Services: A broad category covering clothing, entertainment, personal care, education, and other day-to-day expenses.

To facilitate comparison, most calculators utilize a cost of living index. This index assigns a baseline value (commonly 100) to a reference point, such as the national average or a specific major city (like New York City). Other locations are then scored relative to this baseline. A city scoring 130 is considered 30% more expensive than the baseline, while a city scoring 88 is 12% less expensive. This indexing allows for quick relative comparisons between numerous locations.

How Cost of Living Calculators Work: Behind the Numbers

The accuracy and reliability of a cost of living calculator hinge on the data and methodology used behind the scenes. Understanding these components helps you appreciate both the power and the limitations of these tools.

Data Sources: The Foundation

Reputable calculators synthesize data from a variety of sources to build a comprehensive picture:

- Government Agencies: Organizations like the U.S. Bureau of Labor Statistics (BLS) provide foundational data through surveys like the Consumer Price Index (CPI) and Consumer Expenditure Survey (CES).

- Private Data Providers: Companies such as the Council for Community and Economic Research (C2ER) or the Economic Research Institute (ERI) conduct specialized surveys and maintain extensive databases, often focusing on professional living costs or corporate relocation data.

- Real Estate Data Aggregators: Sources providing current rental rates and home sale prices are crucial for the housing component.

- Crowdsourced Data: Platforms like Numbeo gather real-time price inputs from users worldwide, offering broad coverage but potentially variable accuracy. Learn more about different cost of living index methodologies.

- Direct Research: Some providers conduct their own surveys or use web scraping techniques to gather specific price points.

Calculators combine data from government, private, and user sources.

The "Basket of Goods": What's Being Compared?

Most indices rely on comparing the cost of a standardized "basket" of goods and services across different locations. This basket aims to represent the typical purchases of an average household. While standardization ensures consistent comparisons, it might not perfectly capture local consumption patterns or the availability of specific goods (e.g., fresh seafood costs in coastal vs. inland cities).

Weighting Categories: Reflecting Budget Priorities

Not all expenses carry the same weight in a household budget. Calculators assign weights to different categories based on average consumer spending patterns (often derived from BLS CES data). Housing typically receives the highest weighting (e.g., 30-35%), followed by transportation, food, and so on. This means significant differences in high-weight categories like housing will have a larger impact on the overall index than differences in lower-weight categories like entertainment.

Calculation, Normalization, and Data Recency

Once prices are collected and weighted, the total cost of the basket in each location is calculated and compared to the baseline (100) to generate the index score. A critical factor, especially in 2025, is data recency. In an era of dynamic economic shifts and inflationary pressures, as seen throughout 2024 and into 2025, the recency of data is paramount. Data that is even 6-12 months old might not fully capture current market realities, particularly in fast-moving sectors like housing or energy. Inflation can quickly render data outdated. Reputable calculators strive to use the most current datasets available, often updated quarterly or semi-annually, but some lag is inevitable. Always check when the calculator's data was last updated.

Step-by-Step: Using the Cost Living Explorer Calculator Effectively

Our Cost Living Explorer calculator is designed for ease of use while providing in-depth insights. Here's how to maximize its potential:

Step 1: Establish Your Baseline

Begin by selecting your Current City from the dropdown menu. Then, input your current annual Gross Salary (before taxes). These two inputs form the foundation for all subsequent comparisons – they define the standard of living you're aiming to replicate or compare against.

Step 2: Choose Your Destination

Select the Destination City you are interested in. Our database covers a vast range of locations, both domestic and international.

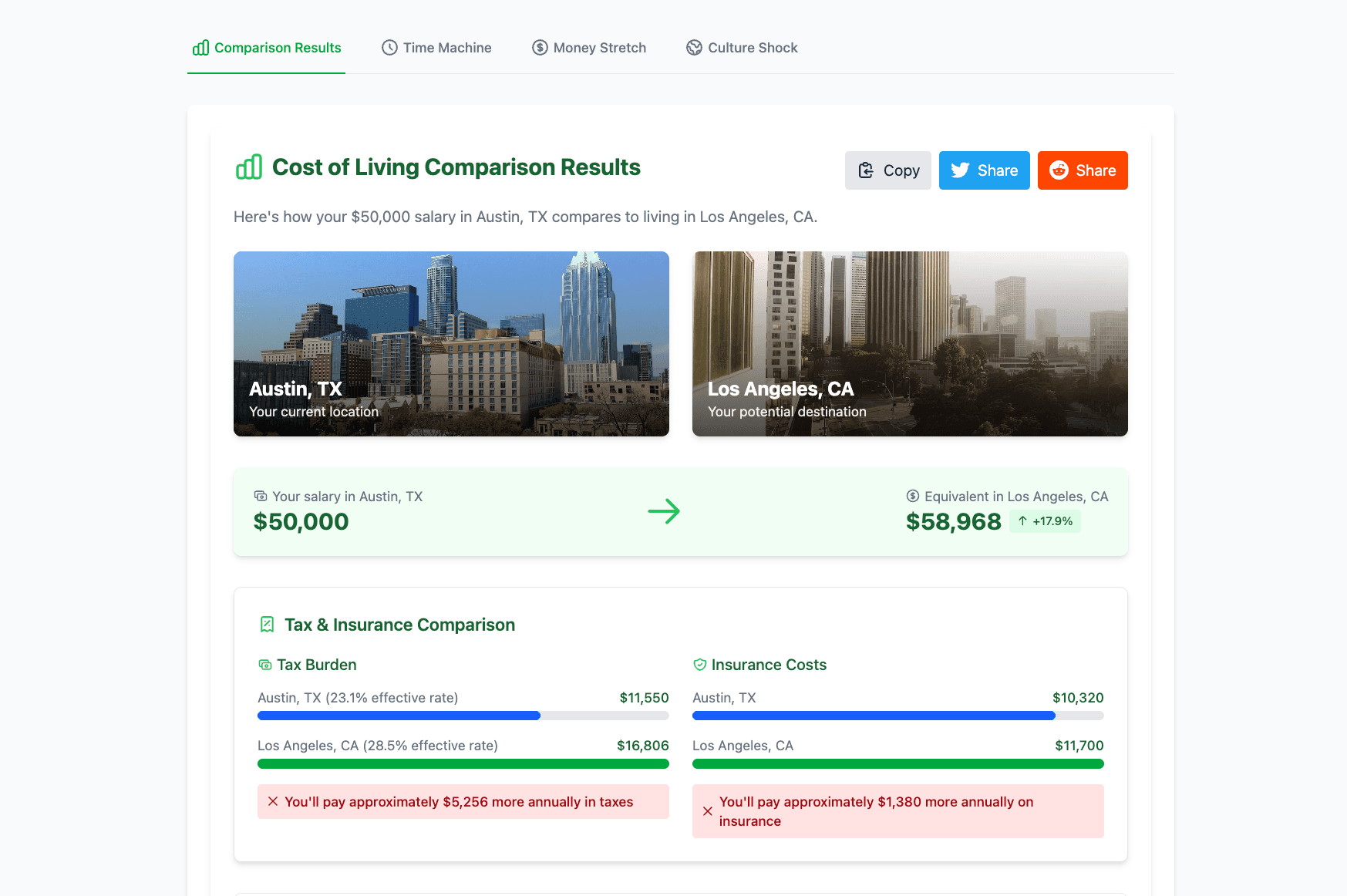

Step 3: Interpret the Core Results

Upon calculation, you'll see the key comparison metrics:

- Equivalent Salary: This is the estimated salary you would need to earn in the destination city to maintain the same purchasing power as your current salary in your current city. This is often the most cited result.

- Overall Percentage Difference: This shows how much more or less expensive the destination city is compared to your current location, expressed as a percentage.

Key results include equivalent salary and overall percentage difference.

Step 4: Dive Deeper – Analyze the Cost Breakdown

Don't stop at the headline numbers! The real value often lies in the detailed breakdown by expense category. Our calculator provides comparisons for:

- Housing: Compare typical rents (e.g., 1-bedroom, 3-bedroom) and potentially estimated home prices. Consider how neighborhood choices within the destination city might affect these costs.

- Transportation: Look at differences in gas prices, public transit fares, insurance, and potential commute costs based on typical patterns.

- Food: See comparisons for both grocery costs and average restaurant meal prices. How does this align with your eating habits?

- Healthcare: Compare estimated costs for insurance and common medical services. This is particularly important if you have specific health needs.

- Taxes: Understand the potential impact of differing state and local income tax rates, sales taxes, and property taxes on your net income.

- Utilities & Miscellaneous: Compare costs for energy, internet, clothing, entertainment, etc.

Analyzing this breakdown allows you to see *why* the overall cost of living differs and how those differences align with your personal spending priorities. Pro Tip: As you review these categories, jot down which ones are most significant for *your* budget. If housing is 50% of your expenses, a 10% difference there is far more impactful than a 50% difference in a category that's only 5% of your budget. Ready to see the specifics? Try the detailed breakdown on our Cost Living Explorer calculator.

Beyond the Basics: Advanced Strategies & Considerations

To truly master cost of living comparisons, you need to go beyond the default calculator inputs and consider your unique circumstances.

Personalizing Your Calculation

Standard calculators use averages, but your life isn't average. Mentally adjust the results based on:

- Household Size & Composition: A single person's budget differs vastly from a family of four. Factor in costs like childcare, larger housing needs, and education expenses if applicable.

- Spending Habits: Are you naturally frugal or do you enjoy frequent dining out and entertainment? Do you prioritize travel? Your discretionary spending significantly impacts your personal cost of living. For example, if you have high recurring medical expenses not fully covered by insurance, or significant student loan payments, these personal factors will need to be mentally layered onto the calculator's output as they are typically outside the scope of a standard 'basket of goods.'

- Housing Choices: Do you need a large house in the suburbs or a small apartment downtown? Renting vs. buying also has major implications.

- Debt Load: Existing debts like student loans or credit card payments affect your disposable income and aren't typically included in standard CoL calculations.

Factoring in Non-Calculator Costs: The Hidden Expenses

Relocation involves more than just ongoing living expenses. Don't forget potential one-time or often overlooked costs:

- Moving Costs: Hiring movers, renting trucks, shipping belongings – these can add up to thousands. For a cross-country move, professional movers can easily cost $5,000-$15,000+, a sum that needs separate budgeting beyond ongoing living expenses.

- Deposits & Setup Fees: Security deposits for rent, utility setup fees, initial furnishing costs.

- Licensing & Registration: Driver's license fees, vehicle registration in the new state/city.

- Temporary Housing: Potential need for short-term accommodation while searching for permanent housing.

While not part of the *ongoing* cost of living, these initial hurdles are crucial for relocation budgeting. For more details, check out our article on the Hidden Costs of Moving.

Quality of Life vs. Cost of Living: Finding Your Balance

The cheapest city isn't always the best city *for you*. Financial feasibility is essential, but so is your overall well-being and happiness. Weigh the financial data against crucial quality of life factors:

- Commute Time & Traffic Stress: A lower housing cost might be offset by a longer, more stressful commute.

- Job Market & Career Opportunities: Does the city offer growth potential in your field?

- Safety & Crime Rates: How comfortable will you feel in the environment?

- Schools & Education Quality: Critical for families or those pursuing further education.

- Community & Culture: Does the city's vibe, diversity, and social scene align with your preferences?

- Climate & Environment: Weather patterns, air quality, and access to nature/recreation.

Balance financial data with important quality of life considerations.

Remember, a lower cost of living might not be worth it if it comes at the expense of poor air quality, lack of job opportunities in your field, or a community that doesn't feel like a good fit. Finding the right balance is key. Explore these Quality of Life Factors in Depth in our dedicated article.

Common Use Cases & Scenarios (with Examples)

Cost of living calculators shine in various real-world scenarios:

Evaluating a Job Offer & Salary Negotiation

Scenario: You earn $80,000 in Austin, TX, and receive a job offer for $95,000 in Boston, MA.

Using the Cost Living Explorer, you find that maintaining your Austin lifestyle in Boston requires approximately $115,000. The $95,000 offer, while higher nominally, represents a significant pay cut in terms of purchasing power. This data empowers you to:

- Negotiate for a higher salary (closer to $115k or more), citing the cost of living difference.

- Ask for a signing bonus or relocation package to offset initial costs.

- Make an informed decision about whether the career opportunity justifies the financial adjustment.

Use cost of living data as leverage in salary negotiations.

Learn more strategies in our guide on how to Use CoL Data for Salary Negotiation.

Planning for Retirement Relocation

Scenario: You plan to retire with a fixed annual income of $70,000 from pensions and savings, currently living in San Jose, CA.

Using the calculator, you can explore potential retirement destinations. You might find that your $70,000 income in San Jose provides the same purchasing power as $45,000 in certain cities in Florida or Arizona. This allows you to identify locations where your retirement funds will stretch significantly further, potentially enabling a more comfortable or active retirement lifestyle.

Choosing a Location for Remote Work

Scenario: You work remotely for a company based in Chicago, earning $100,000, but you have the freedom to live anywhere in the US.

The calculator becomes a tool for geographic arbitrage. You can compare Chicago to numerous lower-cost cities. Moving to a city where the equivalent salary for your $100k Chicago lifestyle is only $75,000 effectively gives you a $25,000 boost in disposable income, which could be used for savings, travel, or lifestyle upgrades, all without changing your job or base salary.

Budgeting & Financial Planning

Even if you aren't moving, comparing your city to the national average or similar cities can provide valuable context for your budget. Are your housing costs unusually high? Is transportation cheaper than average? This understanding can inform your budgeting priorities and financial goals.

Understanding Accuracy & Limitations: Reading Between the Lines

While incredibly useful, cost of living calculators are not crystal balls. Interpreting their results wisely requires acknowledging their inherent limitations:

- Data Lag & Volatility: As mentioned, data takes time to collect and process. In periods of high inflation or rapid market shifts (like housing booms), calculator data might slightly lag behind real-time conditions.

- Averages vs. Reality: The calculator uses average consumption patterns. Your personal spending habits might make certain categories more or less impactful for you.

- Intra-City Variations: Costs can vary significantly between neighborhoods within the same city. The calculator provides a city-wide average; local research is needed for neighborhood specifics.

- Quality Differences: Higher prices sometimes correlate with higher quality goods or services (e.g., better schools, more amenities), which the index doesn't directly measure.

- Methodology Matters: Different calculators use different data sources and weighting, leading to potentially different results. Understanding the methodology helps interpret variations.

So, how do you navigate these limitations? The key is to treat the calculator as an intelligent starting point, not the final word. Here's how: Best Practice: Use calculator results as a strong starting point, but always supplement them with targeted research. Look at actual apartment listings in neighborhoods you like, check local grocery store prices online, research specific school district ratings, and talk to people who live there if possible. Consider comparing results from 2-3 reputable calculators to get a consensus range. Explore our articles on Calculator Accuracy Factors and different Index Methodologies for a deeper dive.

Conclusion: Empowering Your Financial Future with Smart Comparisons

The path to financial clarity in a complex world begins with the right tools and the knowledge to use them. A cost of living calculator, especially when understood and applied intelligently, is one of the most effective tools at your disposal. By understanding how they work, utilizing their detailed breakdowns, personalizing the results to your situation, and acknowledging their limitations, you can transform raw data into actionable knowledge.

Whether you're chasing a career opportunity, seeking an affordable retirement, embracing remote work freedom, or simply aiming for better financial awareness, mastering the cost of living calculator empowers you to make choices that align with both your financial goals and your desired lifestyle. Don't just look at the numbers – understand them, question them, and use them to build a more secure and fulfilling future.

Frequently Asked Questions

How do I use a cost of living calculator effectively?

Start by entering your current city and salary, then compare to destination cities. Review category-by-category breakdowns (housing, food, transport, healthcare) rather than just the summary number. Adjust for your personal spending patterns - if you spend more on dining out or less on transportation, factor that in. Use the calculator results as a starting point, then research actual costs in target neighborhoods.

What salary do I need to maintain my lifestyle in a new city?

Use a cost of living calculator to get your equivalent salary based on the cost index difference between cities. For example, if you earn $100,000 in New York (index 100) and move to Austin (index 68), you would need approximately $68,000 to maintain the same purchasing power. However, also factor in taxes, as some states like Texas have no income tax while others like California have rates up to 13.3%.

How often are cost of living calculator data updated?

Quality calculators like Cost Living Explorer update data quarterly or semi-annually using sources like the Bureau of Labor Statistics CPI, Census data, and real-time housing market information. Look for calculators that display their last update date. Avoid calculators with data older than 12 months, especially during periods of high inflation or rapid housing market changes.

What is the most important factor in cost of living comparisons?

Housing costs typically represent 25-40% of total living expenses and show the greatest variation between cities. A city might have 50-100% higher housing costs than another while food and utilities differ by only 10-20%. When evaluating calculator results, pay closest attention to housing category differences, as this will have the largest impact on your budget.

Can I use a cost of living calculator for international moves?

Yes, but exercise extra caution. International comparisons face challenges including currency exchange rate fluctuations, vastly different tax systems, healthcare coverage models (US vs. universal healthcare countries), and major lifestyle/consumption pattern differences. Use calculators specifically designed for international comparisons and supplement heavily with expat forums and local research.

Ready to put this knowledge into practice?

Related Articles

Understanding the Cost of Living Index: A Comprehensive Guide

Learn how cost of living indices are calculated and how to use them effectively when planning a move.

How Remote Work is Changing Cost of Living Considerations

Explore how the rise of remote work has transformed how people choose where to live based on cost of living factors.